As Europe stops relying on Israel for arms exports, the Jewish state is looking for new markets, forging alliances with right-wing authoritarians who will likely use those weapons against their own citizens.

By Ryan Wentz and Sahar Vardi

Honduran president Juan Orlando Hernandez was supposed to light a torch during Israel’s 70th Independence Day ceremony next week. But on April 9th, citing fear of protests in Israel against his inclusion, Hernandez cancelled his appearance. Indeed, there is a history of anti-Hernandez protests in Honduras and abroad; massive protests erupted following reports of corruption in the balloting in the country’s elections in December, in which he won by a very slim margin. According to human rights groups, at least 22 people were killed by security forces in the aftermath.

So why was Hernandez even selected to light a torch in the first place? Beyond Prime Minister Netanyahu’s domestic political considerations are the strong and growing ties between the two right-wing governments. Just two weeks ago, Honduras purchased $200 million worth of Israeli drones, begging the question: how does Israel’s arms trade affect and feed into its political and foreign policies?

The Stockholm International Peace Research Institute (SIPRI) recently published an updated report on international arms transfers, showing Israel’s numbers continuing to grow. While SIPRI only tracks the sales of leading companies in the arms industry — and there are many more sales, deals, and trainings that go unrepresented in these figures — the statistics give us a glimpse into the trends of Israel’s military exports.

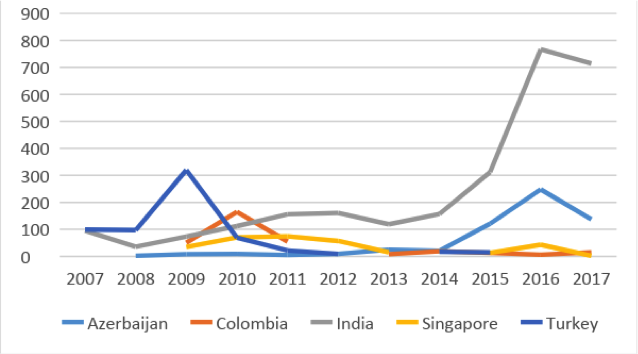

Between 2008-2012 and 2013-2017, Israel increased its arms exports by 55 percent — the largest increase in the world. Looking at overall sales, one sees a dramatic increase in sales in 2015 and 2016, respectively, as well as two low points in 2008 and 2014, both followed by significant increase in arms exports. The figures raise a number of questions: what can explain the sudden decrease in arms sales one year, or a sharp increase in another? What can these numbers teach us about local and international politics?

The global economic crisis of 2008 could certainly be a contributor to the decrease in arms sales that year, but would not be enough to explain the increase the following year to a level higher than before the economic crisis. The other significant event that occurred in 2008 was Operation Cast Lead, which lasted three weeks and provoked international criticism over Israel’s excessive use of force and human rights violations in Gaza. As a result, several countries pledged to cut military ties with Israel.

Exports in 2014 decreased to nearly the same low as 2008, following the 51-day Operation Cast Lead, also in Gaza. One sees an increase to nearly $400 million in Israeli arms sales in the year following both wars. In his documentary film, “The Lab,” Israeli journalist Yotam Feldman shows exactly how such military operations are used as a marketing opportunity for Israeli arms industries. Or as reporter Barbara Opall-Rome put it: “For the military industries, this confrontation is like drinking an especially strong energy drink – it gives them a big push forward.” Those working inside the industry make similar observations. “After every operation of the kind we see today in Gaza, we see an increase in the number of foreign clients,” said one Israel Weapons Industries (IWI) executive in 2014.

The price of killing

One can learn much about regional geopolitics by breaking down these ups and downs by country. When looking at the five biggest customers of Israeli arms in the past decade, the one that stands out is Turkey. Israel’s relationship with Turkey, the Jewish state’s top client, is a notable one; in 2009, Turkey purchased around $320 million worth of weapons from Israel.

Yet there have been no such deals over the last two years, and the decline since 2009 can be linked to the strained relationship between the two countries. President Recep Tayyip Erdoğan was vocal in his opposition to Operation Cast Lead, going so far as to say that the war would harm military relations between the countries. Israel continued exporting weapons to Turkey in 2010, but by 2011 came another drop in sales, following the Israeli attack on the Gaza flotilla, which led to the killing of eight Turkish nationals and the subsequent cutting of Israeli-Turkish diplomatic relations.

Profit from crisis

Israel has steadily provided a small number of weapons to Colombia over the past decade, with a significant increase between the years 2009-2011. While the increase in 2009 can be explained as part of the global trend, that increase does not fit in with the general trend during those years. In 2009, Colombia doubled its arms imports, a tendency that continued in 2010, and which only dropped in 2011.

In April 2009, Colombian armed forces launched an offensive against FARC guerrilla forces, primarily in the northern Arauca region near the Venezuelan border. By 2010, the armed conflict grew into a diplomatic showdown with neighboring Venezuela, and Israeli weapons exports to Colombia tripled from the previous year.

Old markets, new markets

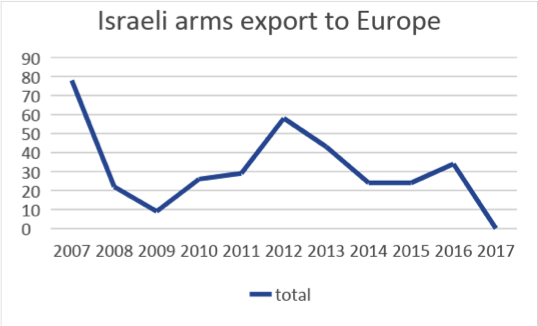

Israeli arms sales to Europe peaked in 2007 and have since been in constant decline. Unlike the global trend, there was no significant increase in 2015 and 2016, with 2017 bringing about a significant drop in exports. As a result, Israel constantly needs to find new markets.

While Turkey and Colombia have at times provided Israel with that market, numerous other countries have proved particularly reliable and profitable. Israel’s ties to India, for example, have strengthened significantly in recent years. While India has imported Israeli weapons consistently for some time, Israeli exports to India have increased exponentially following Narendra Modi’s election as prime minister in 2014. Exports doubled from 2014 to 2015, and again between 2015 to 2016. India is now far and away Israel’s top weapons client, and the top arms importer in the world.

Because of its Hindu nationalist leadership, its “inability to build an efficient and robust indigenous defense manufacturing capability,” and regional pressure from Pakistan and China, India has emerged as an ideal partner for Israel. Both Modi and Netanyahu have focused on this relationship; Modi recently made history by being the first Indian prime minister to visit Israel, and then soon after hosted Netanyahu in New Delhi. Like India, the Philippines and its right-wing government have also prioritized security. Though the numbers are low relative to India, they are nonetheless trending upwards. Sales from Israel began in 2015, but grew by over five times from 2016 to 2017. Like in India, the Filipino leadership has emphasized the need for the modern technology that Israel specializes in.

Looking at the data as a whole, two things become clear: 1. Israel’s arms exports decrease during high-profile military operations, yet they increase dramatically after such operations; 2. Israel’s market share is shifting to the East, and beyond seizing opportunities in local conflicts around the world, is today based heavily on alliances between right-wing governments — governments that, much like Israel, will likely use these weapons against people under their sovereignty.

Ryan Wentz is a graduate of University of Colorado, Boulder and is currently volunteering with the American Friends Service committee. Sahar Vardi is a Jerusalem based activist and program coordinator for the American Friends Service Committee.